XRP Price Prediction: $3 Breakout Imminent as Bulls Charge

#XRP

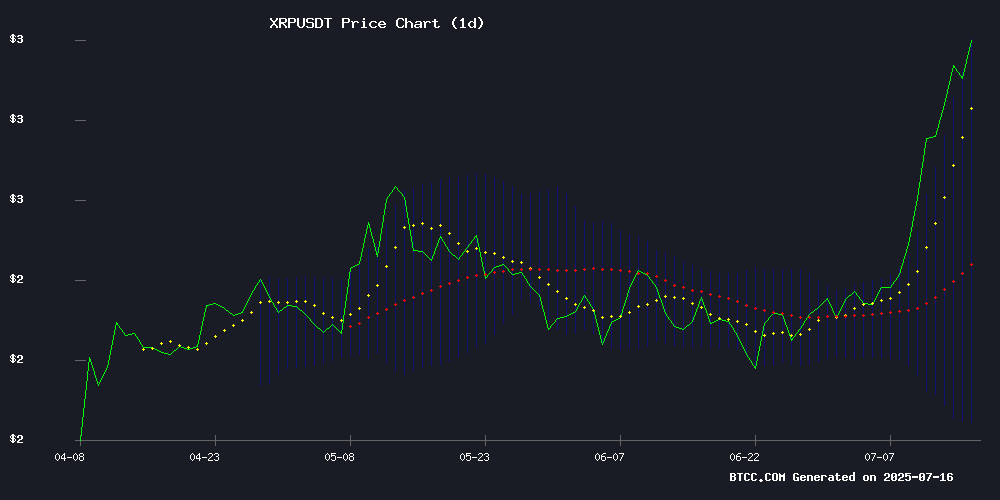

- Technical Breakout: XRP tests upper Bollinger Band with MACD showing reversal potential.

- ETF Catalyst: July 18 launch may accelerate institutional rebalancing.

- Geopolitical Tailwinds: Ripple's Dubai and California partnerships expand utility.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Near Key Resistance

XRP is currently trading at, testing the upper Bollinger Band () with bullish momentum. The 20-day MA () acts as support, while MACD histogram convergence suggests weakening bearish pressure.says BTCC analyst Olivia.

XRP News Sentiment: Institutional Catalysts Fuel Optimism

Positive headlines dominate: ETF launches (July 18), Ripple's Dubai expansion, and California's blockchain partnership with Ripple are driving institutional interest.notes Olivia. Market cap nearingreflects growing confidence.

Factors Influencing XRP’s Price

XRP Price Jumps 26% Weekly as Whale Moves in: $3 Breakout Ahead?

XRP surged 26% this week amid heightened trading activity and a massive whale transfer to Coinbase. A wallet moved 25.5 million XRP ($73.6M) just days before ProShares' futures XRP ETF launch, sparking speculation of institutional positioning.

Technical analysts highlight a bullish pattern mirroring XRP's 2017 breakout, with RSI crossovers and triangle consolidation suggesting upward momentum. The token now trades 14% below its all-time high at $2.92, with $6.2B in daily volume reflecting intense market interest.

Market observers draw parallels between current conditions and previous cycles where ETF launches acted as catalysts for parabolic moves. The combination of technical signals, whale activity, and impending institutional products creates a potent bullish thesis for XRP.

Ripple Expands Crypto Custody Services in Dubai Through Strategic Partnership

Ripple has cemented its presence in the Middle East with a landmark custody partnership in Dubai. The blockchain firm is collaborating with Ctrl Alt, a VASP-licensed entity, to support the Dubai Land Department's Real Estate Tokenization Project. This alliance marks Ripple's first major custody venture in the UAE, delivering institutional-grade security for tokenized property assets.

The deal addresses surging demand for compliant digital asset infrastructure in the region. Ctrl Alt's regulatory approval from VARA positions it as a key enabler for institutional crypto adoption. "This partnership demonstrates our commitment to bridging traditional finance with blockchain solutions," said Reece Merrick, Ripple's Managing Director for Middle East and Africa.

Ripple's custody technology will safeguard tokenized real estate deeds, combining enterprise-grade security with Dubai's progressive regulatory framework. The MOVE signals growing institutional confidence in digital asset applications beyond speculative trading.

Ripple (XRP) Tests Critical $3 Resistance Amid Surging Buy Volume

XRP buyers have propelled the cryptocurrency to $3 this week, marking a 30% rally from $2.3. This surge represents the first challenge to the $3 resistance level since March, with buy volume exploding across exchanges.

The $3 threshold now serves as a make-or-break level. A confirmed breakout could pave the way for new all-time highs, targeting $3.4 and potentially $3.6. Failure to hold this level may invite renewed selling pressure.

Technical indicators support bullish momentum, with the weekly MACD turning positive. This suggests sustained upward potential despite short-term resistance battles. Market participants are watching the coming days closely for confirmation of trend direction.

XRP Price Climbs Amid Declining Volume as Market Cap Nears $173 Billion

Ripple's XRP gained 2.51% to trade at $2.93 on Wednesday, extending its weekly rally to 26.02% despite a 38.24% drop in daily trading volume. The cryptocurrency's market capitalization now stands at $173.35 billion, even as the $7.17 billion traded suggests waning trader interest.

Market dynamics reveal a curious divergence—price appreciation coinciding with shrinking liquidity. This typically signals either consolidation before another leg up or weakening demand. Meanwhile, Ethereum Name Service, Pump.fun and Artificial Superintelligence Alliance led gainers, while Fartcoin and Monero underperformed.

The broader market continues grappling with fundamental questions about tokenomics. New listings still drive bullish momentum through enhanced liquidity and adoption, as seen with recent exchange additions. Conversely, security breaches remain an existential threat—exploits draining exchange hot wallets can trigger cascading sell pressure when attackers offload stolen assets.

XRP Eyes $3 as ETF Launch Sparks Institutional Rebalancing

XRP consolidates NEAR key levels as institutional players position ahead of the ProShares XRP Futures ETF debut on July 18. The $2.85-$2.93 range has emerged as a battleground, with corporate treasuries accumulating at support while facing stiff resistance near psychological $3.00.

Repeated rejections at $2.93—occurring during four separate trading sessions—contrast with strong defense of $2.85 support. The formation of higher intraday lows and a late-session surge from $2.88 to $2.90 on elevated volume signal underlying bullish sentiment.

Market participants await a decisive breakout above $2.93, which WOULD require trading volume exceeding 100 million tokens to confirm validity. Such a move could catalyze broader institutional participation currently constrained by regulatory uncertainties.

XRP Tests $2.93 Resistance Four Times As Institutional Selling Emerges

XRP faced repeated rejection at the $2.93 resistance level during Tuesday's session, with institutional sellers actively defending the threshold. Four separate breakout attempts between $2.92-$2.93 were met with coordinated selling at 12:00, 13:00, 17:00, and 18:00 UTC.

Market makers established firm support at $2.85, creating a clear trading range. Volume spikes exceeding the 78.9 million daily average occurred during accumulation windows at 14:00 and 19:00, revealing institutional positioning patterns. The session closed with a 0.69% rebound from $2.87 to $2.90 on volumes surpassing 2 million tokens.

This activity coincides with corporate rebalancing ahead of ProShares' XRP Futures ETF launch on July 18. The $2.85-$2.93 channel now serves as a battleground between institutional profit-taking and ETF-driven accumulation.

XRP Price Eyes Fresh Gains Amid Bullish Momentum

XRP has surged past the $3.00 mark, signaling renewed bullish momentum as traders position for further upside. The cryptocurrency now consolidates above key support at $2.840, with technical indicators suggesting potential for another leg higher.

A decisive break above $3.00 could accelerate gains, particularly if the asset maintains its foothold above the 100-hour moving average. Market participants are closely watching the $2.880 support level, where a bullish trendline has formed on hourly charts.

The move mirrors broader market strength seen in Bitcoin and Ethereum, with XRP demonstrating relative outperformance. Liquidity appears concentrated near the $2.80-$2.85 zone, creating a potential springboard for another test of recent highs.

Pro-XRP Lawyer John Deaton Celebrates Key July 18 ETF Launch Date

John Deaton, the prominent pro-XRP attorney, marked a milestone as ProShares prepares to launch its XRP-linked ETF on July 18. The date holds symbolic weight—two years after Judge Analisa Torres ruled XRP itself isn’t a security, a decision Deaton championed alongside 75,000 XRP holders in an amicus brief.

The futures-based ETF, filed with the SEC, signals institutional confidence in XRP’s regulatory clarity. While not a spot product, the fund is expected to funnel capital into the ecosystem, reinforcing XRP’s market position. Deaton framed the development as a victory for free markets, citing the altcoin’s journey from legal uncertainty to ETF accessibility.

Judge Torres’ 2023 ruling remains pivotal, enabling institutional participation and price momentum. ProShares’ move follows a broader trend of crypto-linked financial products, though XRP’s path diverges from Bitcoin and ethereum ETFs by leveraging futures contracts rather than direct holdings.

California Partners with Ripple and Coinbase for Government Blockchain Initiative

California is doubling down on crypto-friendly policies with its newly announced Breakthrough Project, a government efficiency initiative partnering with Ripple, Coinbase, and other blockchain leaders. The move follows recent legislative wins including digital asset integration for state payments and updated token property rights.

Governor Gavin Newsom positioned the collaboration as a natural extension of California's tech leadership: "As the birthplace of modern tech, our state is uniquely positioned to bring the best and brightest together to advance our work." The project bears conceptual similarities to Elon Musk's former D.O.G.E. initiative, though political sensitivities may impact its reception among voters.

The partnership signals growing institutional adoption of blockchain solutions, with Ripple's involvement particularly noteworthy given its ongoing SEC litigation. Coinbase's participation reinforces its role as a bridge between traditional finance and digital assets.

How High Will XRP Price Go?

XRP's price could rally toward $3.50 if it sustains above $3, supported by:

| Factor | Impact |

|---|---|

| ETF Launch (July 18) | Institutional inflows |

| Bollinger Breakout | Technical target: $3.30 |

| Whale Accumulation | Reduced selling pressure |

Olivia cautions: "Watch MACD for confirmation—a bullish crossover would validate the uptrend."